Once a Pro has Manifested or Invoiced (as indicated in blue in the order screen snapshot below), any adjustment to a Customer or Vendor charge must be made by filling out and submitting a C&D form via email to the Revenue Accounting Group for IMC Companies at RevenueAccounting@imcc.com

There are two types of C&D forms. One for a Single Invoice Credit/Debit Request & a two-part Bulk Credit & Debit request. These Excel forms are available from our Sharepoint Site/IMCU Tab/IMCU Documents/IMCU folder, via this LINK OR can be requested from the Revenue Accounting Department via the email address above.

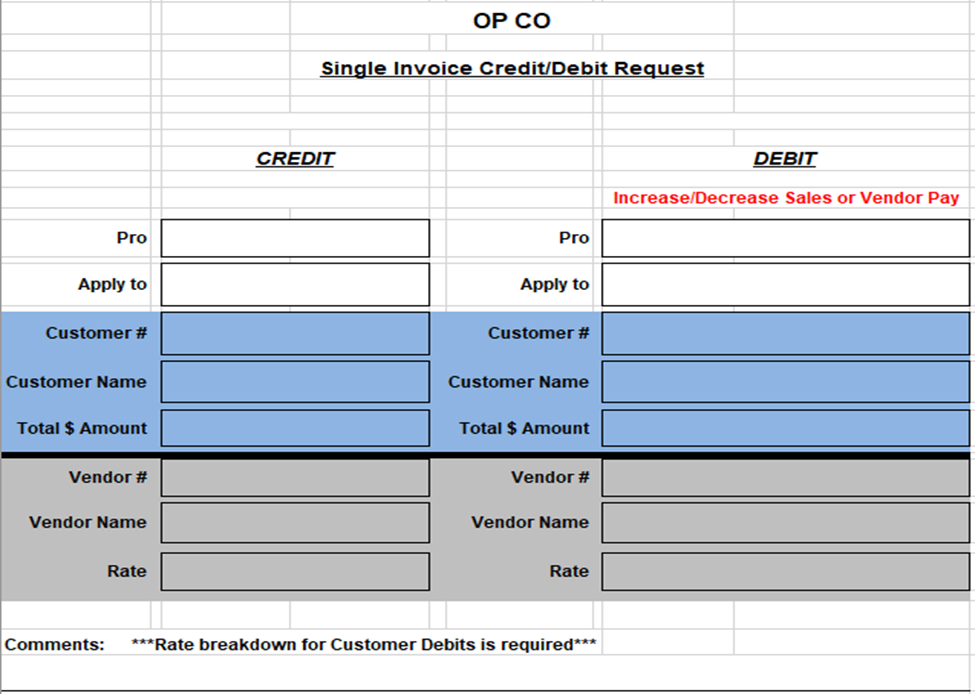

Single Invoice Credit/Debit Request

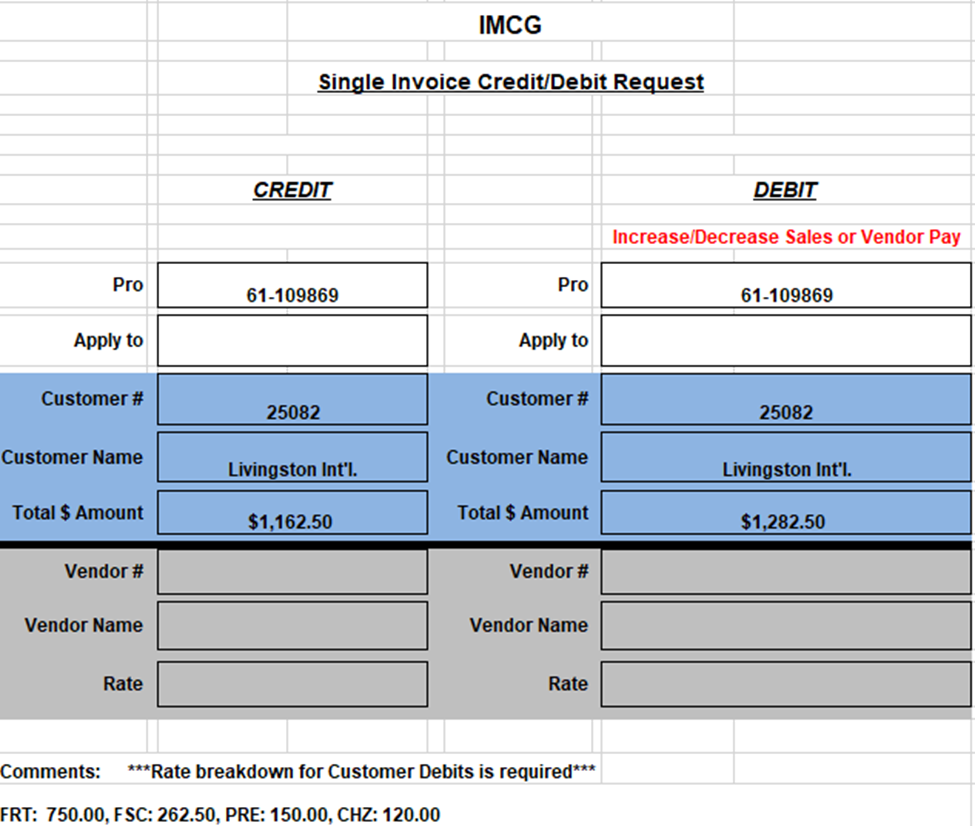

An example form is shown below; instructions on how to complete this form follow.

<<<Enter the Name of the Operating Company (OP CO) at the top of the form.>>>

For a C&D that applies to a Customer (Bill-To), fill out the BLUE section of the form.

On the CREDIT side of the form:

1) Enter the Div/Pro # in XX-XXXXXX or X-XXXXXX format.

2) Enter the Customer (Bill-To) # (Example below)

3) Enter the Customer name (Example below)

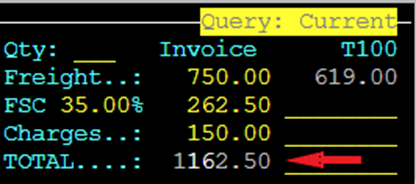

4) Enter the Total $ Amount (TOTAL Customer Charges field) (Example below)

On the DEBIT side of the form:

1) Enter the Div/Pro # in XX-XXXXXX or X-XXXXXX format.

2) Enter the Customer (Bill-To) #

3) Enter the Customer name

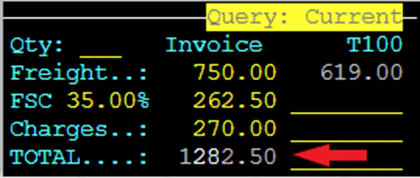

4) Enter the NEW Total $ Amount of what the Customer Charges should be.

In the example below, chassis charges of $120 were erroneously left out. Total charges should have been $270 instead of $150 so the correct invoice total is $1282.50

NOTE: These are example screenshots only, changes are not actually made to the Charges or TOTAL fields in the order screen itself. Based on this example, the C&D form would be filled out as below:

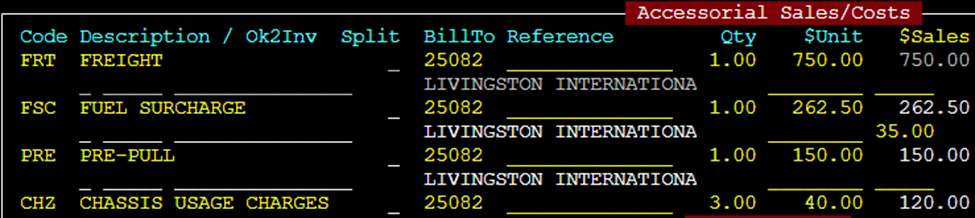

***A complete rate breakdown for Customer Debits is required, to include each accessorial code & dollar amount listed individually (as above). The total of the rate breakdown must equal the (Debit) Total $ Amount***

In the example above, the rate breakdown equals $1282.50.

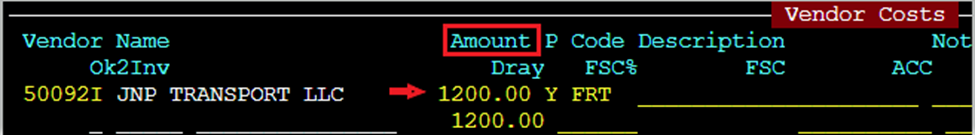

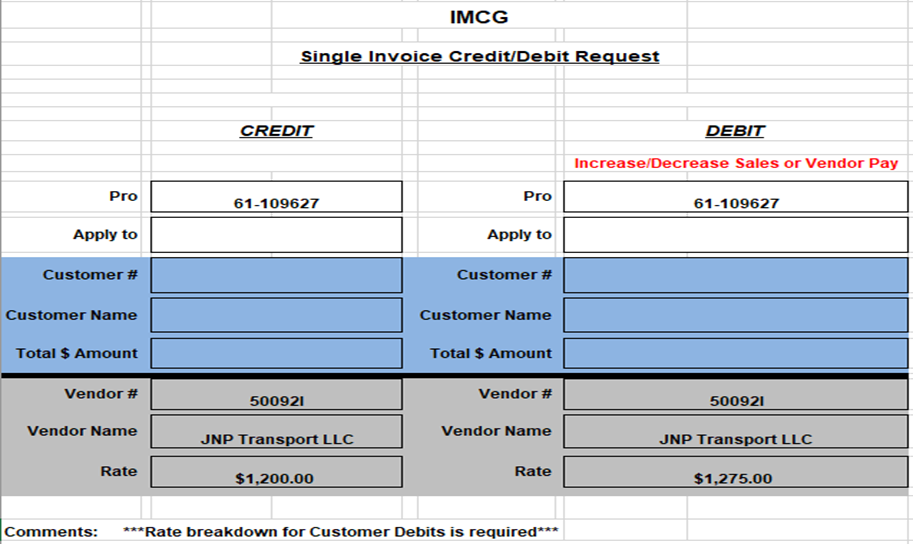

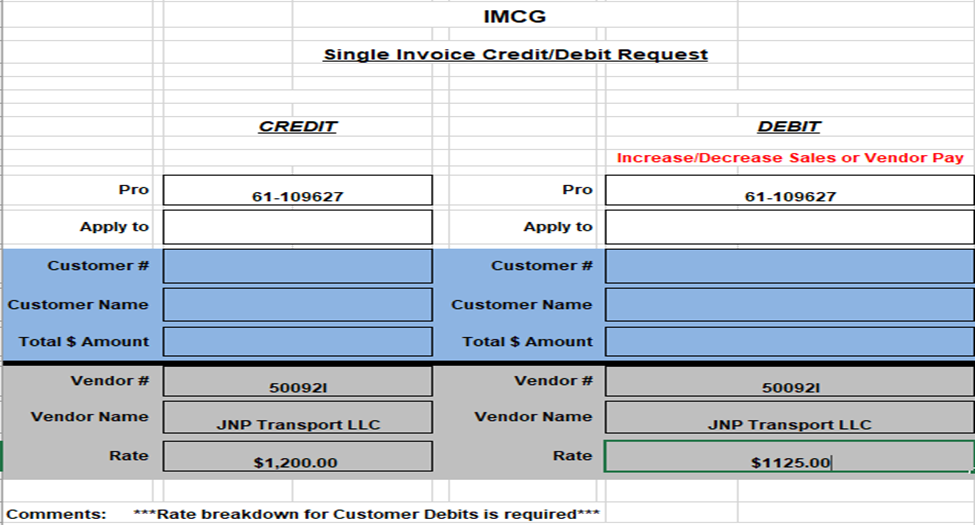

For a C&D that applies to a Vendor, fill out the GRAY section of the form.

On the CREDIT side of the form:

1) Enter the Div/Pro # in XX-XXXXXX or X-XXXXXX format.

2) Enter the Vendor #

3) Enter the Vendor name

The Vendor # and Vendor name can be found under Vendor Costs by hitting the “F8” key when the Order is displayed. (See example below) If multiple vendors were used, be sure to reference the correct one.

4) Enter the Total Rate Amount that the Vendor was paid. In the example above, the dray rate was $1200.

On the DEBIT side of the form:

1) Enter the Div/Pro # in XX-XXXXXX or X-XXXXXX format.

2) Enter the Vendor #

3) Enter the Vendor name

4) Enter the NEW Total Rate Amount of what the Vendor Costs should be

For this example, let’s assume the Vendor was not paid for a $75 yard pull. The C&D form would be filled out as below:

Reversely, if the Vendor had been overpaid $75, the C&D form would be filled out as below:

NOTE: A rate breakdown for Vendor Debits is not needed so this section will be left blank.

This form would be used when requesting the same adjustment for the same Vendor or Customer but for multiple orders. It should be filled out the same way as the single invoice in that there will be both a Credit & Debit (form) completed. The tab for each sheet is located at the bottom of the worksheet as below:

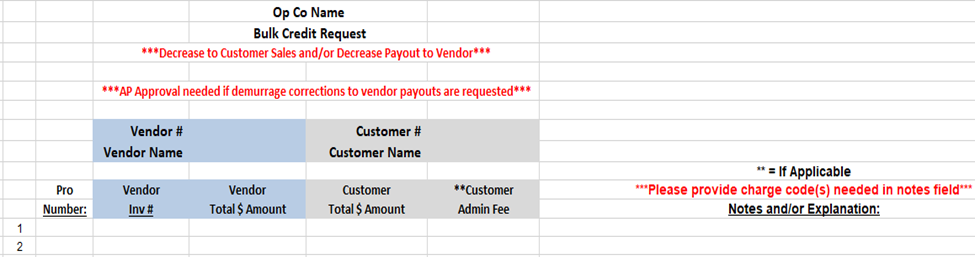

An example (Bulk Credit) form is shown below. To complete this form, see instructions below.

<<<Enter the Name of the Operating Company (OP CO) at the top of the form.>>>

For a C&D that applies to a Vendor, fill out the BLUE section of the form.

On the CREDIT (tab) of the form:

1) Enter the Vendor #

2) Enter the Vendor Name

3) Enter the Div/Pro # in XX-XXXXXX or X-XXXXXX format per line

4) Enter the Vendor Inv # (if known) per line

5) Enter the Total $ Amount (Amount Invoiced)

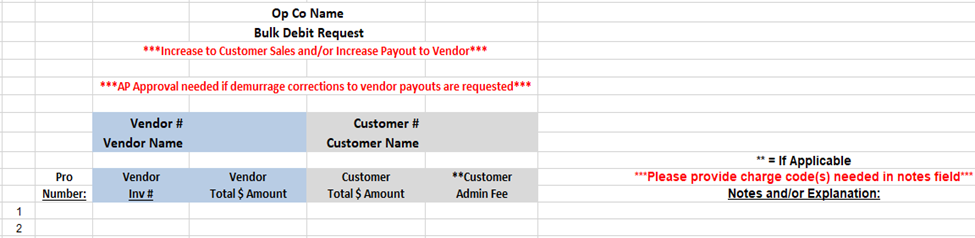

On the DEBIT (tab) of the form:

1) Enter the Vendor #

2) Enter the Vendor Name

3) Enter the Div/Pro # in XX-XXXXXX or X-XXXXXX format per line

4) Enter the Vendor Inv # (if known) per line

5) Enter the NEW Total Rate Amount of what the Vendor Costs should be per line

NOTE: A rate breakdown for Vendor Debits is not needed so the section below will be left blank

For a C&D that applies to a Customer (Bill-To), fill out the GRAY section of the form.

On the CREDIT (tab) of the form:

1) Enter the Customer (Bill-To) #

2) Enter the Customer Name

3) Enter the Div/Pro # in XX-XXXXXX or X-XXXXXX format per line

4) Enter the Customer Total $ Amount (Amount Invoiced) per line

On the DEBIT (tab) of the form:

1) Enter the Customer (Bill-To) #

2) Enter the Customer Name

3) Enter the Div/Pro # in XX-XXXXXX or X-XXXXXX format per line

4) Enter the NEW Customer Total $ Amount per line

5) Enter the Customer Admin Fee (if applicable) per line

***A complete rate breakdown for Customer Debits is required, to include each accessorial code & dollar amount listed individually per line. The total of the (per line) rate breakdown must equal the (per line) Customer (Debit) Total $ Amount***

Once the required Excel forms have been 100 % completed, send them as attachments via email to: RevenueAccounting@imcc.com

***Be sure to include your OP CO name in the Subject line of any emails you send.***

NOTE: There will not be any changes made to the actual invoiced amounts in the Order Screen. However, once the C&D form(s) have been processed, there will be two additional documents visible in the Pro by typing an “I” for Imaging from the Command line when the Pro is displayed.

1) Credit invoice

2) New Debit Invoice

Additional questions should also be directed to RevenueAccounting@imcc.com